Annexures A

- Vision: Invest with knowledge & safety.

- Mission: Every investor should be able to invest in right investment products based on their needs, manage and monitor them to meet their goals, access reports and enjoy financial wellness.

- To enters into an agreement with the client providing all details including fee details, aspects of conflict of interest disclosure and maintaining confidentiality of information.

- To does proper and unbiased risk – profiling and suitability assessment of the client.

- To obtains registration with Know Your Client Registration Agency (KRA) and Central Know Your Customer Registry (CKYC).

- To conducts audit annually.

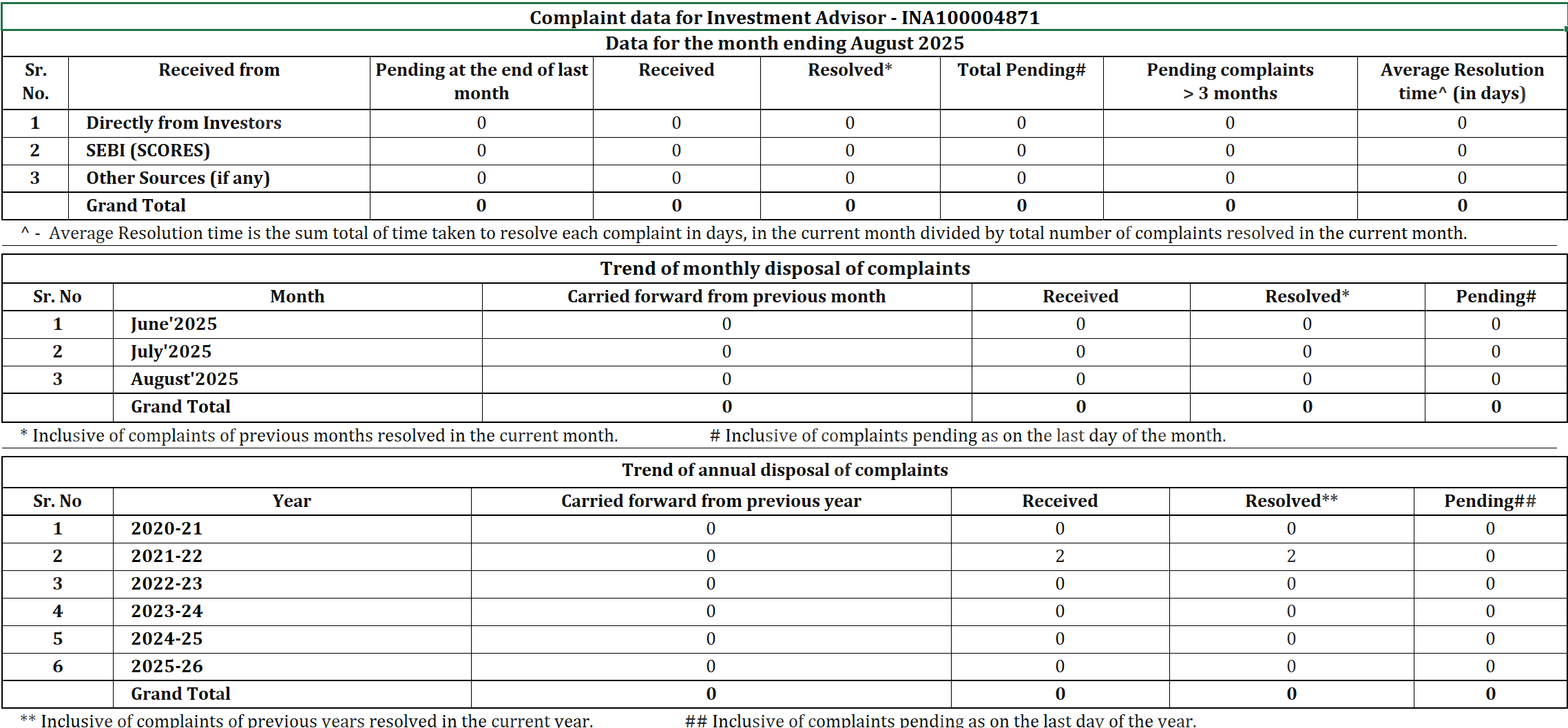

- To discloses the status of complaints on its website.

- Details of Investment Advisor such as name, type of registration, registration number, validity, complete address with telephone numbers and associated SEBI regional/local office details are disclosed on its website .

- To employs only qualified and certified employees.

- To deals with clients only from its official email addresses.

- To maintains records of interactions, with all clients including prospective clients (prior to on boarding), where any conversation related to advice has taken place.

- On boarding of Clients:

- Sharing of agreement copy – On the completion of the on-boarding process, AM Investment shares the signed copy of agreement along with other required documents, with the clients.

- Completing KYC of clients – AM Investment reviews and updates the KYC.

- Disclosure to Clients:

- AM Investment discloses about its business, affiliations, compensation in its agreement.

- AM Investment’s client accounts or holdings are viewed for offering suitable advice and all transactions take place only when the client authorises the same.

- AM Investment discloses the risk profile to the client

- AM Investment uses a combination of multiple factors to arrive at advice and product suitability including risk tolerance, investment objectives, investment experience, knowledge, and capacity of the client to absorb losses.

D.Grievance Redressal Mechanism

We endeavour to offer top-notch services to you. In the unlikely event that you are having any complaints about our services, it’s our utmost duty to sorting it out to your satisfaction.

Information regarding Investor Grievance Redressal Mechanism in Accordance with SEBI Circular No CIR/MIRSD/3/2014 dated 28th August 2014

- Clients can seek clarification to their query and are further entitled to make a complaint in writing, orally or telephonically. An email may be sent to the Client Servicing Team on response@boxpfa.com. Alternatively, the Investor may call on 0120-454 1582.

- A letter may also be written with their query/complaint and posted at the below mentioned address:

AM Investment Advisors and Associates

D – 33, Ground Floor, Sector 2, Noida

Uttar Pradesh – 201301.

- Clients can write to the Investment Advisor at megha@boxpfa.com. If the Investor does not receive a response within 10 business days of writing to the Client Servicing Team. The client can expect a reply within 10 business days of approaching the Investment Advisor.

- In case you are not satisfied with our response you can lodge your grievance with SEBI at https://scores.sebi.gov.in/ or you may also write to any of the offices of SEBI.

For any queries, feedback or assistance, please contact SEBI office on Toll-Free Helpline at 1800 22 7575 / 1800 266 7575

E. Expectations from the investors (Responsibilities of investors):

- Do’s:

- Always deal with SEBI registered Investment Advisers.

- Ensure that the Investment Adviser has a valid registration certificate.

- Check for SEBI registration number. Please refer to the list of all SEBI registered Investment Advisers which is available on SEBI website.

- Pay only advisory fees to your Investment Adviser. Make payments of advisory fees through banking channels only and maintain duly signed receipts mentioning the details of your payments.

- Always ask for your risk profiling before accepting investment advice. Insist that Investment Adviser provides advisory strictly on the basis of your risk profiling and takes into account available investment alternatives.

- Ask all relevant questions and clear your doubts with your Investment Adviser before acting on advice.

- Assess the risk–return profile of the investment as well as the liquidity and safety aspects before making investments.

- Insist on getting the terms and conditions in writing duly signed and stamped. Read these terms and conditions carefully particularly regarding advisory fees, advisory plans, category of recommendations etc. before dealing with any Investment Adviser.

- Be vigilant in your transactions.

- Approach the appropriate authorities for redressal of your doubts / grievances.

- Inform SEBI about Investment Advisers offering assured or guaranteed returns.

- Don’ts:

- Don’t fall for stock tips offered under the pretext of investment advice.

- Do not provide funds for investment to the Investment Adviser.

- Don’t fall for the promise of indicative or exorbitant or assured returns by the Investment Advisers. Don’t let greed overcome rational investment decisions.

- Don’t fall prey to luring advertisements or market rumors.

- Avoid doing transactions only on the basis of phone calls or messages from any Investment adviser or its representatives.

- Don’t take decisions just because of repeated messages and calls by Investment Advisers.

- Do not fall prey to limited period discount or other incentive, gifts, etc. offered by Investment advisers.

- Don’t rush into making investments that do not match your risk taking appetite and investment goals.

- Do not share login credential and password of your trading and demat accounts with the Investment Adviser.