How do you choose a financial planner who suits your needs?

You go to a doctor when your health weakens? But who do you go to for Financial Planning when your wealth starts weakening? Your answer- A Financial Planner. Hiring a Financial Planner is detrimental for your financial health. Just like a doctor is for your physical or mental health. In these challenging times, with the Indian economy struggling beyond measure, Personal Financial Planning can go a long way.

Now, imagine your doctor prescribing some medicine only to gain an incentive offered by its manufacturer. You know what, the consequences could be fatal. But what if your financial planner is practically doing the same?

That’s why experts will always tell you that your financial adviser must be familiar with your financial profile. It allows them to choose the best possible plan for you. But can you trust their judgment if you pay them to sell financial products (like some doctors)? Of course, endorsing a policy or a fund is not that big of a red flag. And there’s a sizable section of investors who may want product recommendations.

Financial planners advise corporate executives or start-up entrepreneurs on how best to save, invest, and grow their money. They can easily help you tackle some specific financial goals, such as buying a house, or give you a macro view of your money and your various assets. Some even specialize in estate planning or retirement, while others consult on a multitude of financial matters.

Our professional financial planners can handle your money planning for you and help you navigate your finances, keeping your circumstances and life goals in mind.

But choosing the right ‘Financial Planning Advisor’ is not as simple as it sounds. First of all, you would want to be sure that you need a financial planner. If you have just started working, you may need a little guidance to start on a savings path. But if you’re in the middle of your career and have tangible long-term goals, you should take a holistic look at your income, assets, and liabilities.

Moreover, the market is always flooded with many different kinds of advisors, for instance, financial planners, independent financial advisors, brokers, agents, and the sort. Your choice will largely depend on the type of services you seek from the planner and the money you want to shell out.

Make Smart Decisions While Choosing Your Financial Planner

Always hire a financial adviser who is a Certified Financial Planner (CFP). They are licensed and regulated, and they indulge in mandatory classes on different aspects of financial planning.

Anyone can hang out as a financial planner, but that doesn’t make that person an expert. They may put a whole bunch of letters after their names. But CFP (short for a Certified Financial Planner) is always the most significant credential.

Furthermore, regulations are more like guidelines now, and it might take some time before strict measures are implemented. Therefore, it’s best to look out for the red flags.

Here are some red flags that you should avoid while choosing a Financial Planner:

-

Credibility and qualification

Certifications from IRDA and AMFI are essentially a license to sell a specific financial product. A certified financial planner is a qualified adviser. It is essential to distinguish the two. It will be better if you pay for a good advice than opt for a free and biased one. You can ask for references and check with existing clients to authenticate their advisory status.

-

Business model & size

What is the source of the planner’s income? Is financial planning his/her full-time profession or just a part-time source of income? If they suggest a product, you have the right to ask if they get a commission on the sale. Be wary if the financial planner gets cagey about disclosing details.

- Planning, not selling

Try scrutinizing if the professional’s advice is a sales pitch or a financial plan. An adviser recommending a product without asking about your financial goals is a significant warning signal. Pushing a product without telling you why it suits you better than other similar products is another sign.

- Portfolio management

Your planner should re-evaluate your financial plan periodically. Even though it’s essentially long-term planning, still a frequent churn of a portfolio, especially long-term investments such as insurance and mutual funds, is a definite warning.

How to choose the right Financial Planner who suits your needs?

A financial planner will have access to all your financial information. If not direct access, or perhaps control your financial accounts. With such a deep relationship, you should certainly indulge in some research to choose some top financial planners and then interview some of them to pick your favorite.

Here are some points that can help:

- What’s their investment style?

Great financial planners possess a sense of your risk tolerance and investment goals. They build a portfolio to suit your needs, but that portfolio, which may look ideal to you, will look different to different planners.

Some people prefer a passive, buy, and hold approach. Others like an active investment style. Choose a financial planner who matches your style, and never change your style to fit your planner.

- Are there any conflicts of interest?

Some financial planners get kickback commissions when they funnel your funds into specific mutual funds or sell specific products. It is a conflict of interest. Under any circumstances, you should never pick a financial planner where this particular conflict exists. Look for a financial planner who is a fiduciary, meaning they must act solely in your best interest.

- Do they work with clients like you?

If you stumble upon a financial planner specializing in financing Baby Boomers, millennials might not think that a specific planner is a good fit. It doesn’t mean they’re bad at their job; they just might not be the perfect fit for you. Make sure whoever you hire is experienced in helping people in your situation and handling similar challenges and goals.

- How have they performed in the past?

Past performances do not guarantee future results. But it’s a good indicator of what to expect. If an adviser’s clients are consistently underperforming against market benchmarks, they may not be worth the cost. You can take a look at BOX Personal Financial Advisors (PFAs) Case Studies and Client Portfolios to see how great a choice we would be.

- How do they communicate?

If you like emails or SMSs, don’t hire a financial planner who only likes to talk by phone. And if you love discussing over the phone, you might not want someone who prefers to send everything digitally.

Again, there is no right or wrong. It is about what you prefer and finds the right match. Choosing a financial planner is kind of like meeting someone new. You may have to sift through many fish before finding someone who is a good fit.

After interviewing, you should know enough to make a long-term decision. But whatever you do, don’t rush. Never pick a financial planner unless you’re sure they are the right person for you.

BOX Personal Financial Advisors can help you fulfill all your Financial Needs and Aspirations

Investments, insurances, taxes, accounting, or lawyers – at BOX Personal Financial Advisors, we do everything. As private CFOs to our clients and their families, we can remove the hassle of coordinating with multiple service providers and provide you a one-stop solution.

If you’re searching for a “financial planner near me” or if you’re looking for financial planning services, look no further. Our Investment approach to wealth Management is solution-oriented.

We believe that individual households need only simple and useful tools to attain their goals. Some families call us their private CFOs, while others consider us as their coaches! If you’re in dire straits regarding your financial situation, call us right now at (+91) 120 – 4541582 or (+91) 9810328797.

PNB Scam and your wealth

My heart goes out the credit analyst sitting in an oblivion in a successful private sector bank. He dared to ask the what if questions. What if the size of the borrowing by Nirav Modi was too good to be true. What if there was more to it than what meets the eye etc. Some of the questions led to his bank missing out on a ‘massive’ business/loan giving opportunity. Probably, he was taken to task by seniors in the bank for putting his red rubber stamp that said Rejected. Probably, for many years the analyst was the butt of all jokes to many and an eyesore to others.

Same is the case for professional wealth advisors. For years together they refuse to change asset allocation or refuse to the next coinomania on the block or refuse to change the funds or refuse to invest in American / Chinese equities. They are at the receiving end of comments like too slow to act, not proactive, boring, too diversified etc. Only years later does it all add up to a prosperous and sustainable wealth growth. And it is only years later he realises that signing up for wealth management included signing up for managing the client (behaviour) too. Infact, investments is just the first lap of a 10 lap marathon.

The first lap is important. Both for the client and the advisor. Through their experiences, over a period of time both parties calibrate their respective approaches and expectations. On an average it takes 7 to 10 years for this maturity to set in. No surprise that the time frame is similar to that of one full economic cycle. A cycle full of hypes and horrors. With so much change around, it is almost a miracle that a highly stable and closed approach comes up on top. Pretty much like the American constitution. It has been amended less than 25 times across a chaotic timeline last 200+ years. And look at the results it has delivered.

Talking about PNB, we have always maintained that Public sector continues to be poor capital allocator. Reason enough we don’t advise CPSE and Bharat 22 ETFs of the world. Another reinforcing investment lesson is that accidents will always happen. Today it’s PNB. Yesterday it was Satyam. Having a concentrated portfolio of instruments may give a slight edge in returns but it exposes the portfolio , — that too not your own portfolio — a portfolio for which we have a fiduciary responsibility – client portfolio, to irreparable damage and loss of capital.

But today our credit analyst is the saviour. The Noah who built the ark many years ago when he did not allow the overenthusiastic sales team to lend to the Nirav Modis of the world. His one simple and brave act of refusal possibly saved the death line risk to his bank. No amount of accolades can compensate for that.

Tax Saving Fund — Axis Vs Reliance

Winters are here in Delhi. My favourite time of the year. Armed with a small coffee mug and my tool kit I am down to doing my favourite thing. Investment Analysis..

A good place to start is my own portfolio. It has a ripple affect as most of our clients are invested in the same funds. So, I decided to review and benchmark the tax saving fund in my portfolio (ELSS) where I invest on a monthly basis.

For these automated and disciplined monthly investments, we recommend investing in mid & small cap equity.

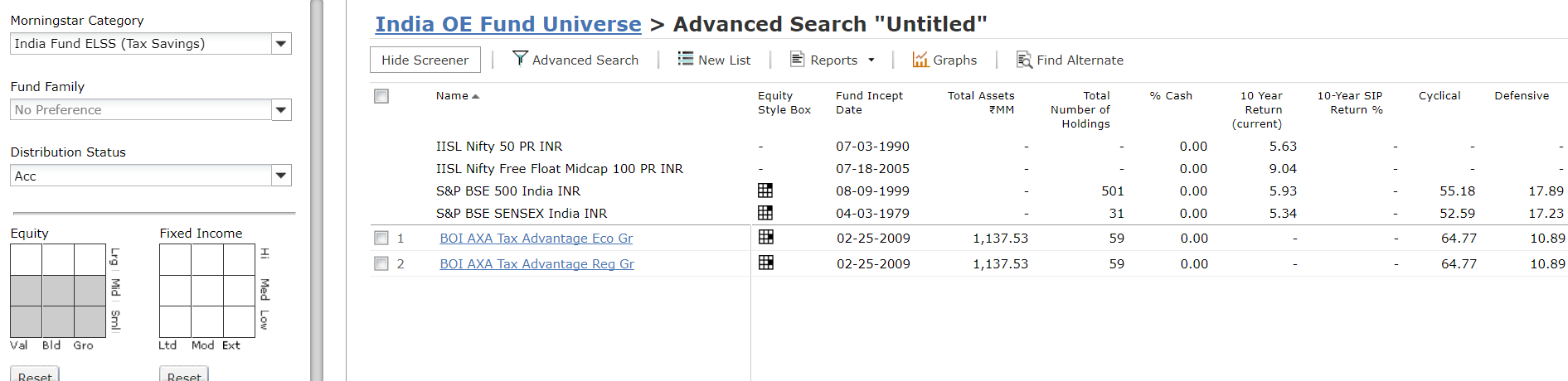

Hence, using Morningstar AdvisorWorkStation (AWS), I pulled out a list of ELSS funds where the portfolios are invested in mid & small cap equity. To my disappointment, there was only 1 fund in the segment — BOI Axa Tax saver fund. Due to lack of options I started drilling on the only fund but it faltered at the first gate for us due to low Assets under Management (AUM) of just over 110 crores.

Then I quickly moved on to use AWS again to filter ELSS funds based on other dimensions e.g. Sectoral break-up (allocation to cyclical sectors versus defensive sectors), Investment strategy (growth Versus value) etc.

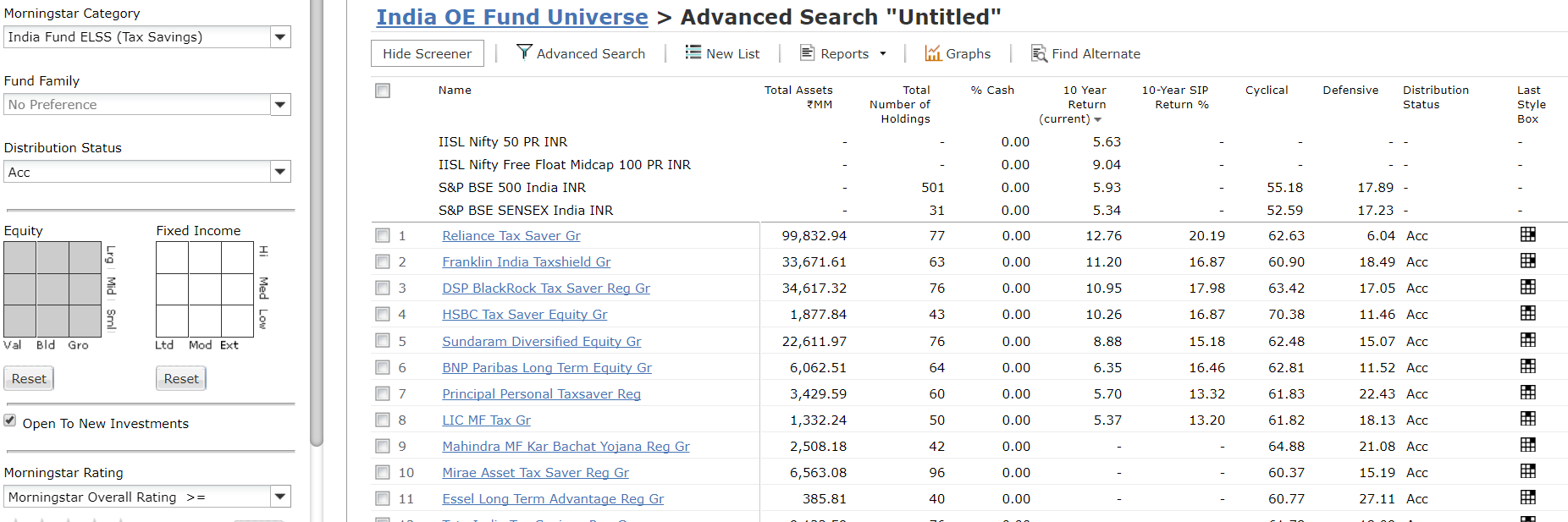

Within the sectoral break-up dimension, I applied the next internal filter of more than 60% in cyclical sectors. The resulting results were then arranged in a descending order of 10 year performance. On the top was Reliance Tax saver fund. It also had the highest return in 10 year SIP category. As it’s sectoral allocation and other parameters (like fund size, number of instruments etc.) were meeting our filters, we decided to shortlist it as a contender for the next round which could lead it to being included into our recommended list for tax-saving funds .

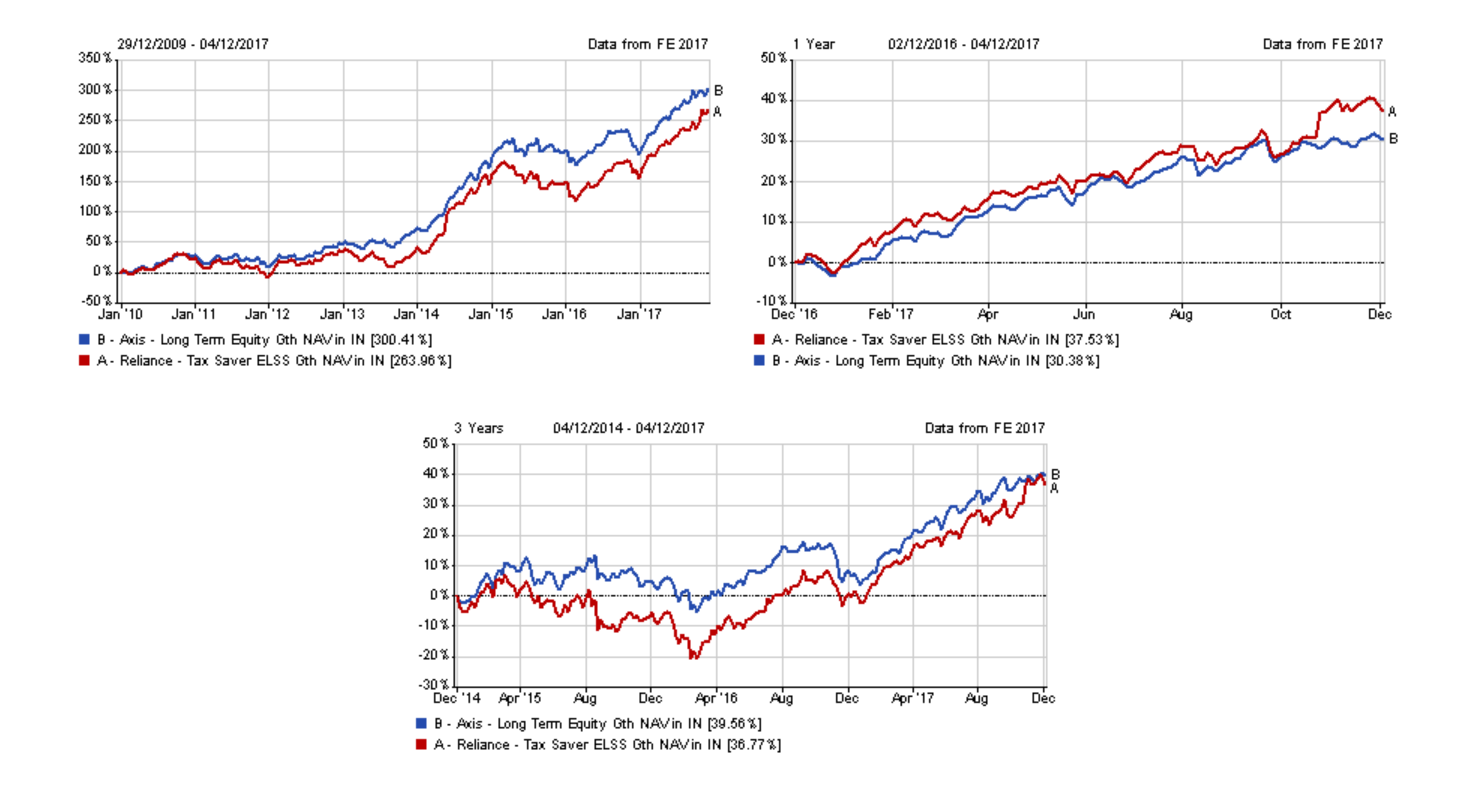

Curious beings that we humans are, I immediately wanted to compare it’s performance with the ELSS fund I am personally invested in — Axis Long Term Equity Fund. Currently, we mostly use Financial Express (FE) analytical tool for performance analytics. It’s more visual.

I was pressed to see that Axis was under-performing in the last one year (as on 4th Dec 2017). Not the one to give up easily, I went on to compare their longer-term performances and to my relief, Axis was doing better!

This brings me to another point that in the long-run, fund selection has minimal impact on your returns. If i was to take a shot — 2 to 3% plus or minus!

What is important is that you have the overall portfolio construction right, avoid ‘reinventing the wheel’ mistakes and safeguard your portfolio from your behavioural pitfalls. Hopefully, I will be discussing these in other posts.

Back to Axis Vs Reliance.

Now i needed to investigate the Axis’s under-performance in the last year for academic purposes. Clearly, there was a sudden spike in Reliance performance in the last 2 months. We raised the query with the Reliance team . Also, I decided to review the individual sectors these funds are bullish on. I also wanted to check if there had been a major change in the sectoral strategy of the funds.

It threw up following questions which we have forwarded to the Axis team:

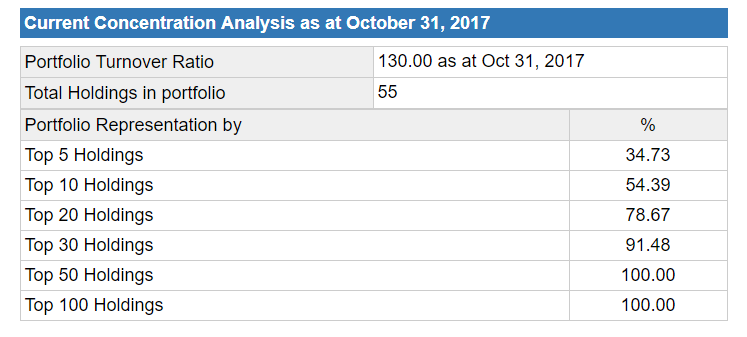

- Do we have any instrument level rules for maximum allowed exposure? Top 5 & 10 instruments account for almost 35% & 55% of the portfolio respectively. That’s a lot of concentration risk. Ideally, for us, no more than 25% & 35% of the fund portfolio should be invested in top 5 & top 10 instruments respectively. As Indian markets develop further, these ratios should be further brought down. Reliance was slightly better with respect to concentration risk management here??

2. Rationale and accuracy behind the Sectoral break-up of the axis fund — We saw that banking and financial services sector together accounted for about 40% of the Axis fund portfolio. Also, although the portfolio was invested heavily in cyclical sectors (73%) there was negligible allocation (~4%) to the Industrial sector, which we believe is an important part of the cyclical sector basket. See below.

Currently, between the two, Reliance has a better portfolio for us — simply because it seems it is managing the sectoral diversification slightly better.

However, we will not rush into any action immediately. It is prudent to wait for Axis & Reliance to reply, think through other related impacts and evaluate tax lock in periods.

I will update our final take in the comments section in next few days (or may be weeks! Patience is probably our’s firm’s greatest asset).