Tax Saving Fund — Axis Vs Reliance

Winters are here in Delhi. My favourite time of the year. Armed with a small coffee mug and my tool kit I am down to doing my favourite thing. Investment Analysis..

A good place to start is my own portfolio. It has a ripple affect as most of our clients are invested in the same funds. So, I decided to review and benchmark the tax saving fund in my portfolio (ELSS) where I invest on a monthly basis.

For these automated and disciplined monthly investments, we recommend investing in mid & small cap equity.

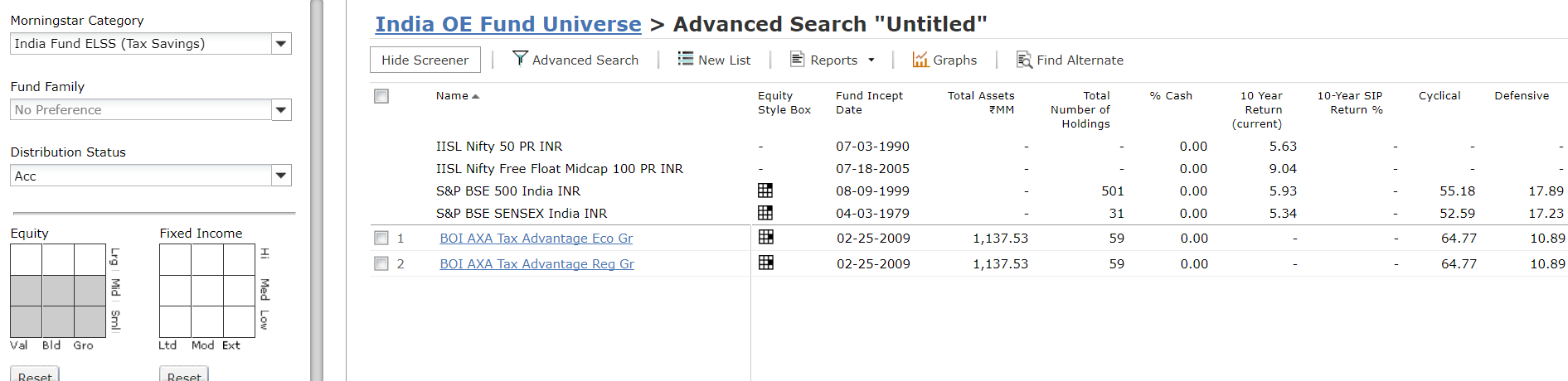

Hence, using Morningstar AdvisorWorkStation (AWS), I pulled out a list of ELSS funds where the portfolios are invested in mid & small cap equity. To my disappointment, there was only 1 fund in the segment — BOI Axa Tax saver fund. Due to lack of options I started drilling on the only fund but it faltered at the first gate for us due to low Assets under Management (AUM) of just over 110 crores.

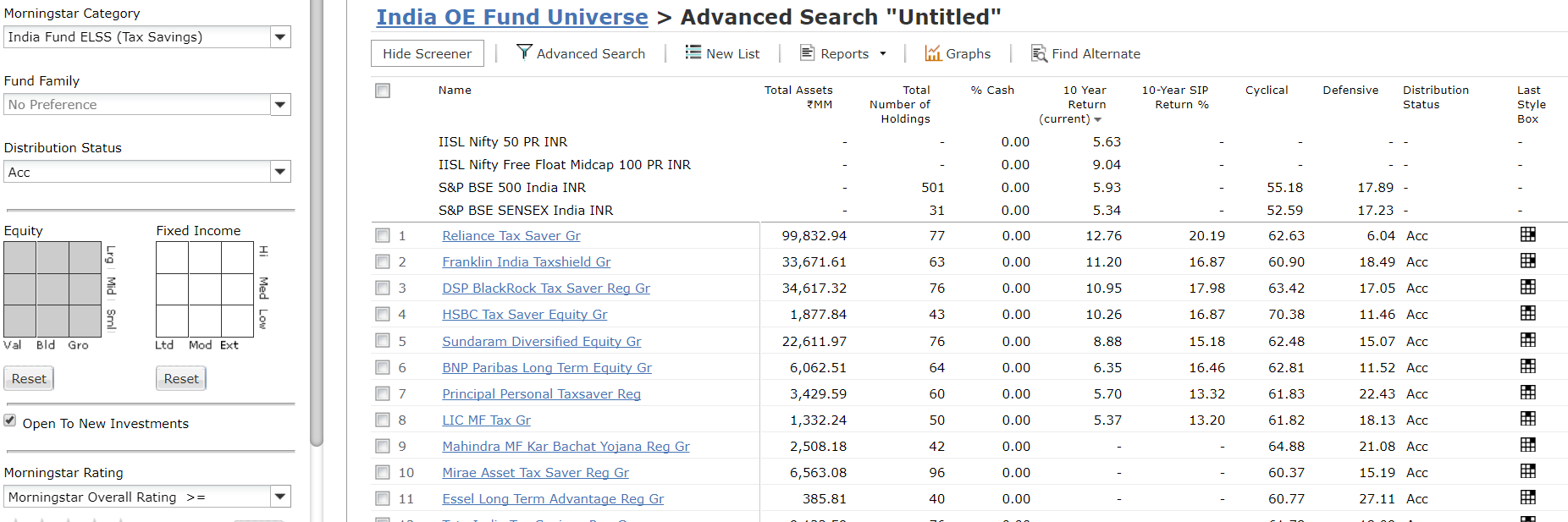

Then I quickly moved on to use AWS again to filter ELSS funds based on other dimensions e.g. Sectoral break-up (allocation to cyclical sectors versus defensive sectors), Investment strategy (growth Versus value) etc.

Within the sectoral break-up dimension, I applied the next internal filter of more than 60% in cyclical sectors. The resulting results were then arranged in a descending order of 10 year performance. On the top was Reliance Tax saver fund. It also had the highest return in 10 year SIP category. As it’s sectoral allocation and other parameters (like fund size, number of instruments etc.) were meeting our filters, we decided to shortlist it as a contender for the next round which could lead it to being included into our recommended list for tax-saving funds .

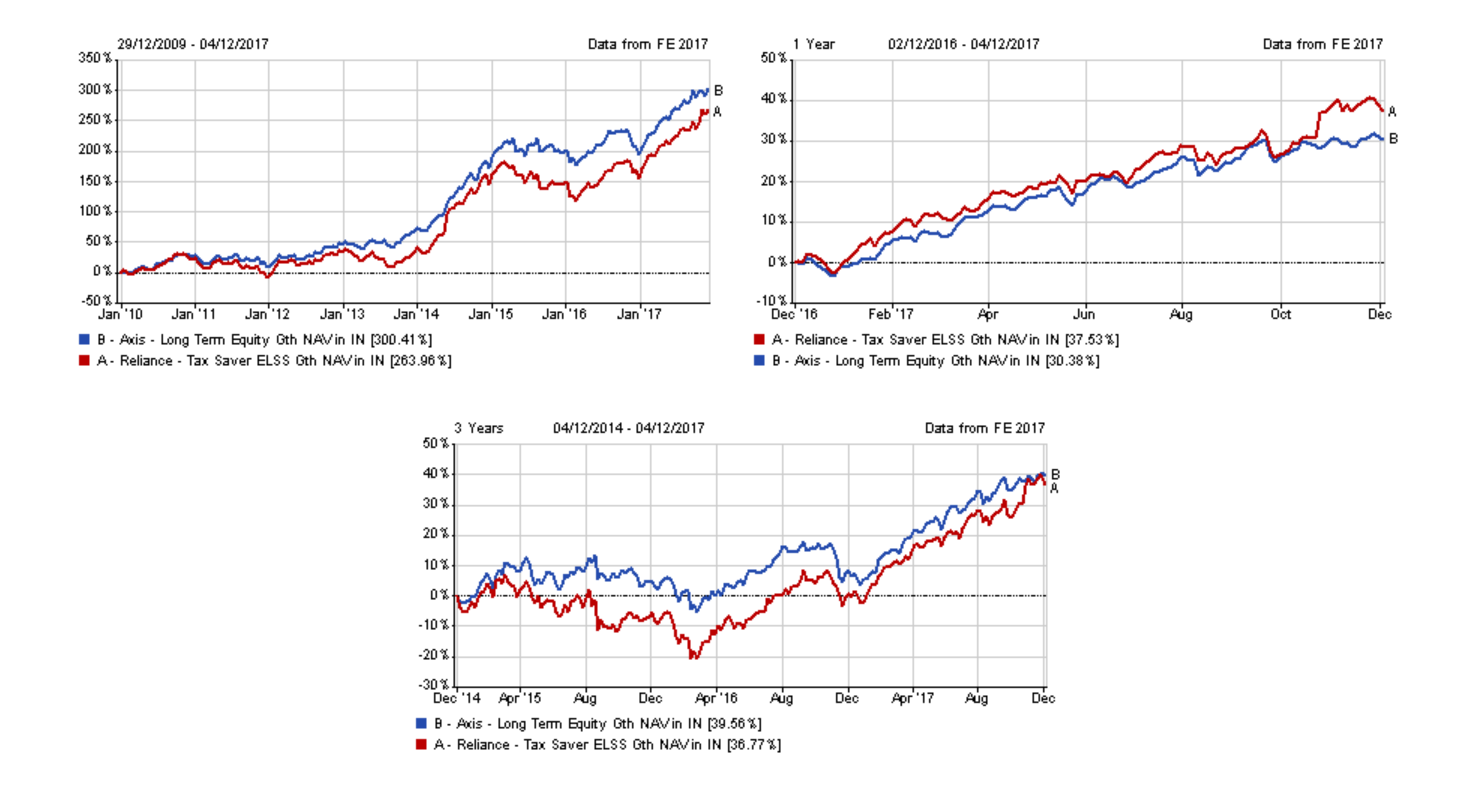

Curious beings that we humans are, I immediately wanted to compare it’s performance with the ELSS fund I am personally invested in — Axis Long Term Equity Fund. Currently, we mostly use Financial Express (FE) analytical tool for performance analytics. It’s more visual.

I was pressed to see that Axis was under-performing in the last one year (as on 4th Dec 2017). Not the one to give up easily, I went on to compare their longer-term performances and to my relief, Axis was doing better!

This brings me to another point that in the long-run, fund selection has minimal impact on your returns. If i was to take a shot — 2 to 3% plus or minus!

What is important is that you have the overall portfolio construction right, avoid ‘reinventing the wheel’ mistakes and safeguard your portfolio from your behavioural pitfalls. Hopefully, I will be discussing these in other posts.

Back to Axis Vs Reliance.

Now i needed to investigate the Axis’s under-performance in the last year for academic purposes. Clearly, there was a sudden spike in Reliance performance in the last 2 months. We raised the query with the Reliance team . Also, I decided to review the individual sectors these funds are bullish on. I also wanted to check if there had been a major change in the sectoral strategy of the funds.

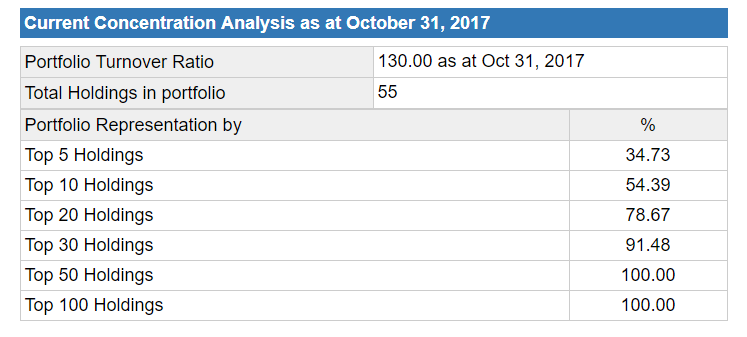

It threw up following questions which we have forwarded to the Axis team:

- Do we have any instrument level rules for maximum allowed exposure? Top 5 & 10 instruments account for almost 35% & 55% of the portfolio respectively. That’s a lot of concentration risk. Ideally, for us, no more than 25% & 35% of the fund portfolio should be invested in top 5 & top 10 instruments respectively. As Indian markets develop further, these ratios should be further brought down. Reliance was slightly better with respect to concentration risk management here??

2. Rationale and accuracy behind the Sectoral break-up of the axis fund — We saw that banking and financial services sector together accounted for about 40% of the Axis fund portfolio. Also, although the portfolio was invested heavily in cyclical sectors (73%) there was negligible allocation (~4%) to the Industrial sector, which we believe is an important part of the cyclical sector basket. See below.

Currently, between the two, Reliance has a better portfolio for us — simply because it seems it is managing the sectoral diversification slightly better.

However, we will not rush into any action immediately. It is prudent to wait for Axis & Reliance to reply, think through other related impacts and evaluate tax lock in periods.

I will update our final take in the comments section in next few days (or may be weeks! Patience is probably our’s firm’s greatest asset).