54 EC Bonds

Taxes can drain out an investor’s annual earnings. Tax Planning is a legitimate tool to reduce tax liabilities while conforming to the legal obligations and hence, tax planning comes as an effective tool in financial planning.

54EC bonds, or capital gains bonds, are one of the best ways to save long-term capital gain tax. 54EC bonds are specifically meant for investors earning long-term capital gains and would like tax exemption on these gains.

The nomenclature of the financial instrument i.e., 54 EC accrues to the fact that these bonds are those assets which enables long term capital gains exemption under Sec54 EC of the Income Tax Act,1961. So, in order to understand what this financial instrument is all about, its crucial to know more about the Sec 54 EC.

What is Sec 54EC of the Income Tax Act,1961?

Where the capital gain arises from the transfer of a long-term capital asset and the assessee has, at any time within a period of six months after the date of such transfer, invested the whole or any part of capital gains in the long-term specified asset, the capital gain shall be dealt with in accordance with the following provisions of this section —

(a) if the cost of the long-term specified asset is not less than the capital gain arising from the transfer of the original asset, the whole of such capital gain shall not be charged under Section 45;

(b) if the cost of the long-term specified asset is less than the capital gain arising from the transfer of the original asset, the cost of acquisition of the long-term specified asset shall not be charged under Section 45.

Provided that the investment made on or after the 1st day of April 2007 in the long-term specified asset by an assessee during any financial year does not exceed fifty lakh rupees.

An example to illustrate.

Point (a)-

| Cost of long-term specified asset | ₹ 50,00,000 |

| Capital Gain arising from sale of land/building | ₹ 30,00,000 |

| Capital gains eligible for exemption from Sec 45 | ₹ 30,00,000 |

Point (b)-

| Cost of long-term specified asset | ₹ 50,00,000 |

| Capital Gain arising from sale of land/building | ₹ 80,00,000 |

| Capital gains eligible for exemption from Sec 45 | ₹ 50,00,000 |

| Capital Gain to be charged u/Sec 45 | ₹ 30,00,000 |

This Section poses a plethora of questions and doubts in the minds of the investor. Some of the FAQs are:

Q) What is a long-term capital asset and on which long term capital asset, capital gain is eligible for deduction u/Sec 54EC?

A) The Finance Act 2017 provides that in case of an immovable property being land or building or both, the period of holding should be 24 months or more to qualify as long-term capital asset. The deduction u/s 54EC is restricted to only transfer or sale of Land or building or both by Finance Act 2018.

Q) Who all are eligible for deduction u/Sec 54EC?

A) Any assessee can claim exemption u/Sec 54EC. Therefore, an Individual, HUF, Company, LLP, Firm etc can claim this exemption.

Q) What is a long-term specified asset?

A) “Long-term specified asset” for making any investment u/s 54EC means any bond redeemable after five years and issued by National Highways Authority of India (NHAI) or by Rural Electrification Corporation Limited or any other bond notified by central government.

Finance Act 2018 has extended the time period to 5 years earlier it was 3 years only.

Q) What is Sec45 of Income Tax Act, 1961?

A) Section 45 of Income Tax Act, 1961 provides that any profits or gains arising from the transfer of a capital asset effected in the previous year will be chargeable to income-tax under the head ‘Capital Gains’. Such capital gains will be deemed to be the income of the previous year in which the transfer took place.

Q) Can Short Term Capital Gains be eligible for Exemption u/Sec 54 EC?

A) No, only long-term capital gains that too on transfer/sale of land or building are eligible for deduction u/Sec54 EC.

Q) What are the time specifications to avail the exemption?

A) The investment of capital gains in these bonds should be made within the period of 6 months from the sale of the long-term asset (from which capital gains are realized).

Q) What is the maximum limit of capital gains exemption u/Sec 54 EC?

A) Investment made by an assessee during the financial year in which the asset or assets are transferred and in the subsequent financial year does not exceed Rs 50 Lakh. Hence, maximum limit of capital gains exemption u/Sec 54 EC is Rs 50 Lakh.

To illustrate this point:

| Cost of House property as on 01-March-2001 | ₹ 10,00,000 | |

| Sale of House Property on 31-Dec-2020 | ₹ 2,00,00,000 | |

| Capital gains eligible for exemption from Sec 45 | ₹ 50,00,000 | |

| Purchase of NHAI Bonds redeemable after 5 Years on- | 20-March-2021(FY2020-21) | ₹ 50,00,000 |

| 20-March-2021(FY2020-21) | ₹ 50,00,000 |

In this case, Capital Gains were invested within 6 months of sale and within 2 different financial years. Ideally, the investor could avail capital gains deduction u/Sec54 EC of Rs 1 crore. But this loophole was taken care of by the Second Proviso u/s 54EC which states Investment made by an assessee during the financial year in which the asset or assets are transferred and in the subsequent financial year does not exceed Rs 50 Lakh. Hence, following will be the treatment in the above situation.

| Sale Price of Asset | ₹ 2,00,00,000 |

| (Less) Indexed Cost of Acquisition [10,00,000*(301/100)] | ₹ 31,60,500 |

| Long-Term Capital Gain | ₹ 1,68,39,500 |

| (less) Deduction u/Sec 54 EC | ₹ 50,00,000 |

| Capital gains to be taxed u/Sec 45 | ₹ 1,18,39,500 |

Q) Can the assessee transfer the 54EC Bonds before the redemption period of 5 years?

A) Finance Act 2018 provides that if the assessee transfers 54EC Bonds or takes any loan or advance on the security of such bonds within the period of 5 years from the date of acquisition of the bonds, the capital gains arising from the transfer which were earlier not charged u/s 45 on basis of the cost of “long-term specified asset i.e. 54 EC Bonds” shall be deemed to be the income chargeable under the head “Capital Gains” of the Previous year in which the 54 EC Bond is transferred or converted into money.

Now that we have understood all about Sec 54EC of the Income Tax Act, 1961; let us dive into some features 54 EC Bonds.

Eligible Bonds– The eligible bonds under Section 54EC are REC (Rural Electrification Corporation Ltd), PFC (Power Finance Corporation Ltd) and NHAI (National Highways Authority of India) and IRFC (Indian Railways Finance Corporation Limited) or any other bond notified by central government.

Returns– The 54EC bonds offer an annual interest rate of 5-5.75 percent.

Risks– These Bonds are AAA Rated. The default rate is extremely low.

Time Horizon– These are 5-year Bonds.

Taxes– Interest is taxable at applicable rates under the head “Income from other sources”. No tax is deducted at source (TDS) on interest from 54EC Bonds and wealth tax is exempted.

Liquidity– The lock-in-period is 5 years and hence, are irredeemable and are non-transferrable.

Unique Feature– It enables long term capital gain exemption u/Sec54 EC.

Limits– The maximum limit for investing in 54EC bonds is ₹50 lakh per financial year, whereas minimum investment is capped at ₹20,000 and ₹10,000 respectively in REC and NHAI bonds.

Is it worth hiring a financial planner?

People are often uncertain about hiring a financial planner. They wonder if hiring a financial planner is worth their money.

How we manage our finances now has a significant impact on our future. After all, isn’t your long-term goal is to save more money, not spend it? Do you know what you’re doing? If you do, that’s good, and if you don’t, you should certainly be mindful of your spending habits. Hiring a financial planner could end up saving you tons of money and making you even more in the long-run.

Who benefits from these financial planners?

Are financial planners worthy for everyone or a select few?

Most people in India argue that financial planning services, though steadily gaining popularity, are just suited for the few rich people who don’t have to go through a common man’s everyday troubles.

Well, that’s not true. Read on to find out how you can benefit from hiring a financial planner:

1. Planning for Retirement

Retirement planning can be complicated, regardless of your current financial situation. You need answers to a lot of important questions, such as:

- When should you stop working?

- When should you start pulling money from investment accounts?

- Are you too late to start investing for retirement?

- How much money do you need to set aside to retire comfortably?

- When should you start collecting social security?

Financial planners and Retirement Planners at BoxPFA can help you plan a successful retirement based on your income, lifestyle, and future plans. We’ll also tell you exactly what you need to do to make all your goals a reality.

2. Managing Your Assets

One of the most important reasons to hire our Financial Planner is that they can help you manage your wealth through various assets and investments, along with providing valuable information about tax planning. They can guide you through the management process or take the reins with your permission, keeping you abreast before, during, and after each decision.

If you make a lot of money, you’ll need help holding onto it rather than forfeiting a large portion over for taxes. A financial planner can help you to legally manage your funds to save as much of it as possible come tax season.

3. Saving Your Money

Practicing some restrictive measures results in you having saved up more. The more you save, the better your investment prospects become. Below we have outlined ways that will help you to save for the future.

- i) Increasing your commitment to savings:

As financial planners, we advocate spending after you save enough, but of course, you should always limit your overspending and start saving more. A financial plan will guide you through automating your monthly investments, which will make you determined to save.

- ii) Lesser Investment Charges:

As financial planners, we don’t recommend schemes with hidden charges. It helps you save on the cost of investments.

Sometimes, we also recommend schemes based on the time horizon. As the schemes are selected based on the required period, generally, there will not be any surrender charges or exit charges.

4. Understanding Investment Options

Another vital role of a financial planner is providing information and advice about investing. Many of us don’t know much about risk tolerance and stocks, bonds, IRAs, along with other forms of investing.

Our financial planners at BoxPFA can put you on the right path for investing money for maximum financial gain. It includes real estate investments, business investment opportunities, taxable bonds, tax-exempt bonds, and more.

5. Planning for a Growing Family

Lastly, many people find comfort in hiring a financial planner when planning their life and future for a new or growing family. A growing family can significantly impact your finances. You’ll need a bigger home, and a bigger vehicle, among other things.

When raising children, you need to work with a financial planner to plan the costs of:

- The baby stage (cribs, diapers, safety modifications, and more)

- Food

- Clothing

- Education

- Activities

- Toys

- Vacations

Financial planning can help you plan for a future with a growing family to ensure you provide an enriching life for your children and shape their future in the best way possible.

Think You Could Benefit From Hiring a Financial Planner? BoxPFA has got you covered

Our Certified Financial Planners at BoxPFA can make everyone save more money and earn more investment returns, so they’re worth your time and money.

If you need financial advice or help manage your finances, retirement planning, making an investment plan, estate planning, planning for long-term financial goals, or understanding various financial products in the market, we’re here for you. Contact us today to speak to a Personal Financial Advisor (PFA) or a Financial Planner and learn more about what we can do for you, your family, or your company.

Sovereign Gold Bonds

Love for “Gold-the lifeline for rainy days” is deeply rooted into the Indian tradition but this love for physical gold when imported is a burden on the Indian economy. The Government of India (GoI) in an effort to monetize physical gold introduced Sovereign Gold Bonds (SGB) Scheme in November 2015.

SGBs are government securities denominated in grams of gold issued by RBI on behalf of GoI. With the Reserve Bank of India issuing these gold bonds, it brings in transparency and trust, providing an avenue wherein people can own gold without having to worry about its storage or safety. The investors have to pay the issue price in cash and the securities will be redeemed in cash on maturity as per the market value of gold.

Sale and Redemption Price of Sovereign Gold Bonds

The nominal value of Gold Bonds as issue/redemption price shall be in Indian Rupees fixed based on simple average of closing price of gold of 999 purity, published by the India Bullion and Jewelers Association Limited, for the last 3 business days of the week preceding the subscription period/ redemption date.

Recently, the tenth tranche of the government’s SGB scheme opened for subscription on January 11 till January 15. For the tenth instalment of the gold bond scheme, an issue price of ₹ 5,104 per unit, equivalent to the value of one gram of gold, is applicable. A discount of ₹ 50 per unit is applicable for those investing in the gold bonds online, and the payment against the application is made through digital mode.

Eligibility– Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors would include individuals, HUFs, trusts, universities and charitable institutions. Joint holding is permitted. Also, a minor can invest in SGB provided the application is made by her/his guardian.

Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time per fiscal year (April – March). Each family member can own maximum 4 kg each in her/his name.

Returns– The bonds bear an interest of 2.5% p.a. paid semi-annually on the amount of initial investment. The bonds will yield capital appreciation at the end of 8 years or at an early redemption date or on sale in the secondary market.

Risks– There is the risk of capital loss in case market prices of gold fall, but the investor will not lose onto the units of gold for which s/he has paid.

Liquidity– The maturity period of the bond is eight years. However, the investor can exit from the scheme after the specified lock-in-period of 5 years or by selling them on Exchanges, if held in demat form. Even part holdings can be redeemed in multiples of 1 gm.

Commission– Commission for mobilizing subscription shall be paid at the rate of Rupee one per hundred of the total subscription received by the receiving offices on the applications received and receiving offices shall share at least 50% of the commission so received with the agents or sub-agents for the business procured through them.

Unique Feature– These bonds are eligible to be used as collateral for loans from banks, financial Institutions and Non-Banking Financial Companies (NBFCs). The Loan to Value ratio will be the same as applicable to ordinary gold loan prescribed by RBI from time to time. Bonds acquired by the banks through the process of invoking lien/hypothecation/pledge alone shall be counted towards Statutory Liquidity Ratio.

Taxation– The Interest Income received by the investor will be entirely taxable as per the applicable Income Tax Rates. For an investor who falls in the 30% tax bracket; interest income will be charged at 30%+4%cess.

Capital gains if received on redemption at its maturity period i.e., 8 years; capital gain will be entirely tax-free. This makes SGB quite a lucrative option. But, if an investor exits the SGB Scheme after the lock-in period of 5 years or sells it in the secondary market, then the capital gains will be taxable in the hands of investor. Short-term capital gains (less than 3 years) will be taxed as per the tax bracket the investor falls in and long-term capital gains (more than 3 years) will be taxed at 10% flat rate or at 20% after getting the indexation benefits.

With the options of holding physical gold, Gold ETFs, Golf Mutual Funds and SGB in a line, Investors usually are in a fix for which option to go for. All these available options come with their own merits and demerits and it is the matching of these options to the needs of the investor that the best option can be figured out.

Physical Gold, being tangible can be put into use as jewellery and it also gives solace to the individual of it being of some value and a dependable asset for tough times. But physical gold is usually expensive as making charges and other such incidental costs inflate its price and the purity of gold always stands questionable. Expenses on its storage cost and the risk of theft etc reduce its lucrativeness.

Gold ETFs is a highly liquid option, wherein investment in gold can be held in demat form and can be traded on stock exchanges just like shares. Returns are usually linked to return on gold and are a suitable option for a short-term investment.

Gold MF are open-ended options and returns usually linked to that on physical gold but the exit load compromises on the return portion. Again, a liquid investment and a suitable option for investors to invest through SIPs.

SGBs as already stated are highly suggested for investors with an 8-year investment horizon, can bring in desired diversification to their portfolio and capital gain tax exemption on redemption plays in their favour. Also, half yearly interest is an add-on to physical gold holding.

Depending on the Risk, Return, Liquidity profile of the investor, s/he can opt for any of the above options to invest in Gold. Gold as a sole asset to depend on in dealing with the life balance sheet is not what is suggested but is highly suggested as an asset class to bring in diversification to the portfolio and an asset one can call on in difficult times.

Real estate & Stamp Duty Value: An income tax perspective

If you are planning to sell or buy a property, this article tells the role of stamp duty value (SDV) in tax planning for both seller and buyer. Knowing the SDV beforehand and planning the transaction amount is important for following two main reasons:

- Sellers point of view — The actual market value/transaction value (TV) in many colonies is lower than the government fixed SDV. e.g. In Friend’s colony, a premium locality in Delhi, SDV has been significantly higher than TV for some time. In certain cases, this notional difference is taxable in the hands of seller as capital gains. e.g.

A sold his flat to P for 100 lakhs. Indexed cost of acquisition was 60 lakhs. SDV on appropriate date was 150 lakhs. Under the normal circumstance capital gains = 100 less 60 = 40 Lakhs. However, since SDV is higher than TV, sale price of 100 lakhs will be replaced by the SDV value of 150. Now seller will have to pay tax on capital gains of 150 less 60 = 90 lakhs which is much higher compared to the capital gains of 40 lakhs as computed above [Section 50 C under capital gains]

Thus, there is a double whammy — Firstly, in the current depressed real estate market cycle, the seller is getting a poor price for his property. Secondly, he is getting taxed higher on notional value that the seller didn’t receive

Buyer’s point of view — As there is a cash outflow for the buyer, it is generally assumed that there are no adverse tax implications in the hands of buyer. However, that is far from reality. In case buyer pays less than the property SDV to buy the property, the difference is taxable in his hands under the head “Income from other source”

What’s worse is that the tax rate for buyer would be much higher if he falls in the 10 lakhs plus net income bracket compared to the reduced 20% [plus indexation benefit] applicable on seller [assuming the capital asset is long-term in nature. For immovable properties if the period of holding is more than two years, gains are considered as long-term]

In the same example as above, P, the buyer will have to pay tax on SDV less TV i.e.150 -100 = 50 lakhs [Section 56 (2) (x) under income from other sources].

Some technical points

- Since there were many deals where TV was less than SDV, tax law makers recently amended to incorporate a tolerance band of 5%. If the SDV is not more than 105% of sale value, both the above sections (capital gains and income from other sources) will not be applicable

- The above sections are applicable only in case of a capital asset. Thus, if the seller is holding the property as stock in trade (e.g. DLF), then section 50 C will not be applicable. There is a separate section dealing with them. Similarly, if the buyer receives it as stock in trade then section 56 (2) (x) will not be applicable

- Relevant date for SDV — generally, SDV on date of registration is considered for the purposes of calculation in above clauses. However, in case there is an agreement to sell before the actual date and the same is evinced by an account paying cheque / draft or electronically cleared payment, SDV on the agreement date can also be considered

- There is also a provision, where the aggrieved parties can request the income tax office to refer his property to a valuation officer. In a case where the valuation officer reduces the market price same will be considered (Upto a minimum of actual transaction price declared) instead of SDV

- If you look closely, the difference between SDV and TV is getting taxed twice. Once in the hands of seller as deemed capital gains and again in the hands of buyer as deemed income from other sources. Apparently, the original intention was to discourage doing transactions below a fair price (SDV in this case). Hence, the double taxation

Hence, whether you are a buyer or seller, it is recommended to keep the transaction value above the stamp duty value.

Disclaimer: Please refer to your tax consultant / wealth advisor before any action. No action will hold for any losses due to any action taken based on this article. This is updated till 31st March ’19.

Slipping Equity Markets. Should you act? Our View.

Equity investors have been going through a tough phase for almost 1.5 years now. Since the time capital gains tax on equity was re-introduced in Jan ‘18.

While the equity markets have been yo-yoing since then ( it fell by ≈ 14% in Aug-Oct ’18; then rose by ≈ 20%; the current market skid is different as it is weighing very heavily, even on the minds of most seasoned wealth owners and advisors.

What is causing the sentiment to turn so bearish as the current slide, standing at ≈ 9%, is still much lesser than the previous slide ≈ 14% in Aug last year?

We feel the key reason is that for the first time in many years economic indicators are pointing to a slowdown of the Indian economic machinery. Of course, media is playing its role very well and hence I will not expound the sentiment by reproducing the list of such indicators.

Our view:

The stems of stress and panic had entwined our minds also and, admittedly, we are still not completely out of the woods. Taking Tony Robbin’s advice, that the only antidote to fear and stress is massive action, we got down to doing exactly that — Talking to fund managers, attending seminars, meeting different market participants, evaluating what the economists had to say, examining the longer term data etc.

The net result of activity can be summed up as — every time recent developments and news take a toll on investor sentiment, one should get back to reading financial history. It helped us zoom out and make our allocations more objectively.

Warren Buffet put it differently when he advised to lock yourself away in a room and think objectively.

Post the discussion, we have communicated recommended portfolio actions to our clients. Broadly, the advice is to stay the course in most cases.

Some of the things we considered:

- Asset Allocation changes — We reminded ourselves the promise of long-band reallocation only. i.e. The only time we will give a call to reduce equity in a major way is when we believe we are at the peak. When everything is firing in all cylinders. Markets. Economy. May be once in 10 years

- The correlation between economic cycle and capital market cycle is not 1. What it means is that even though the economy may continue to slide, markets may actually behave differently and can even go up. In other words, while we feel that the economy will take a couple of quarters to change gears, we can’t predict the market movement in short-term

- J-curve Effect — We believe that a lot of reforms instituted by the Modi government are having a J-curve effect, especially in the context of Indian business. As per the theory, initially there is a setback in response to a fundamental change but as time passes the results bounce back better than ever before. Think of it as your parents forcing you to quit on your girlfriend. You are upset and in a visibly bad shape. And after a few months you get married to Alia Bhatt! That’s the effect GST, for example, must have on the economy!

- Manthan — A very experienced fund manager pointed out a fundamental thing we missed. While the economic growth is clearly in a slowdown mode, there is an opposing force in the form of enabling macro-economic environment. Low inflation, low interest rate and benign fiscal deficit. All these contribute in helping the economic machinery move faster. Currently, there is no clear-cut winner, but the forces are equally potent on both sides

- Credit growth — This indicator has the highest weightage in our analysis. Thankfully, this number is still growing in healthy double digits. Credit / loans have a multiplier effect on the economy. e.g. a loan of 100 bucks can actually have a positive consumption impact of 1000 bucks on an economy

- Equity Valuations — The valuations have corrected significantly in the last few months. Most of the stocks are trading below or near their long-term average valuation parameters

- Staying invested itself is an established strategy which has given handsome returns. Peter Lynch supports this when he says “You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

However, it is one of the most difficult things to do. Key role of advisers is to hand hold their clients through this tough phase. Possibly, this is the kind of times when 10% of investors are able to ignore the pain and come out successful.

Your equity portfolio has under-performed in the last year? That’s good news!

Here is why (using an extract of our recommended portfolio):

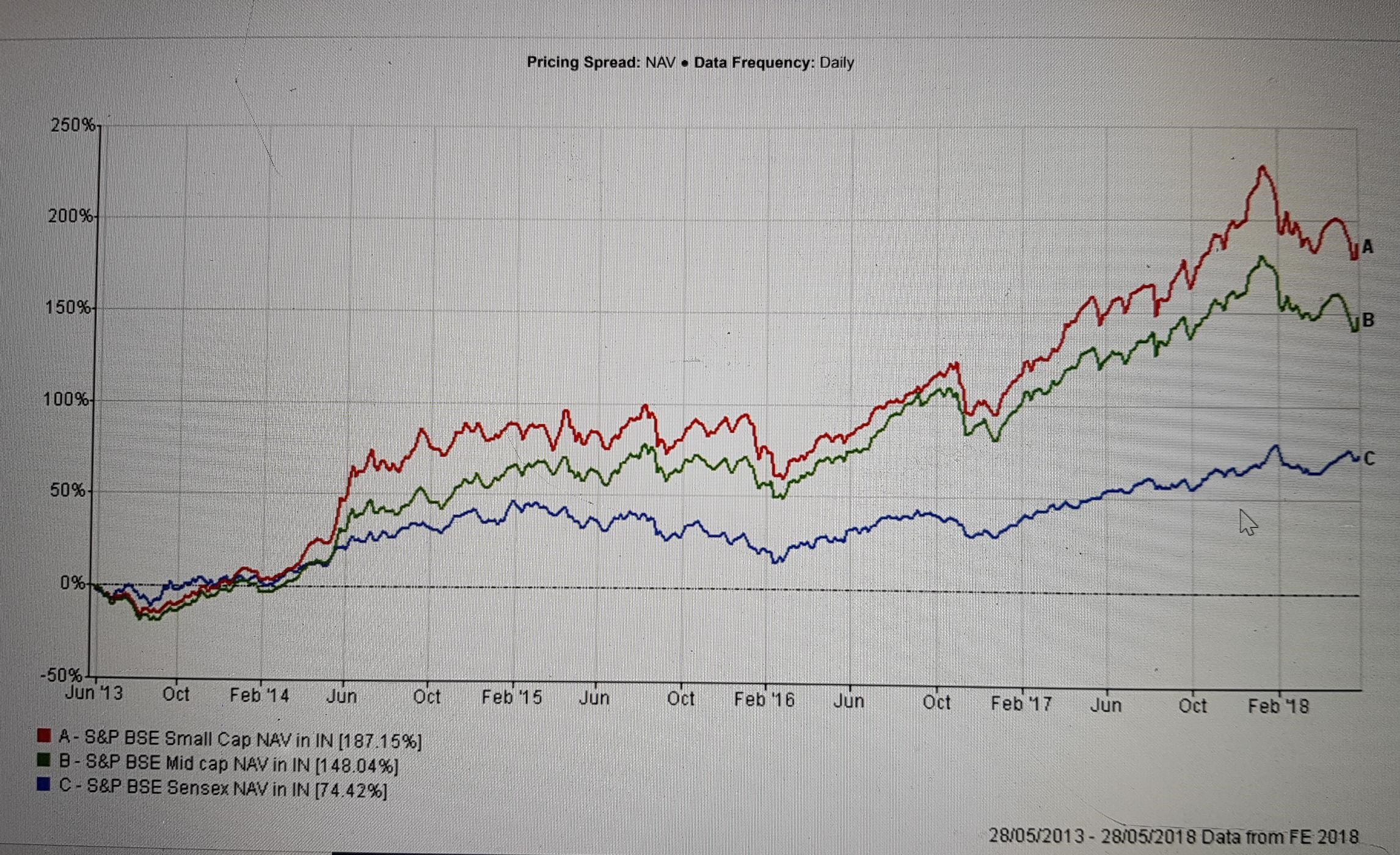

Step -1 — Decide your medium term (3 to 5 yrs) outlook for equity markets. Ours has been positive for last 5 years. Did it go right? Yes! (See chart below Step-2)

Step — 2 — Based on our bullish outlook (step-1), we tilt the equity portfolio traits to certain pockets in scientific ways. e.g. In a bullish phase we advise that mid-caps would usually do better than large-caps. So we overweight our portfolios toward mid-caps relative to the market (but not too much). Compared to about 68–70% of equity market being occupied by large-caps, our equity portfolios have lower allocation to large-caps (~55% to 65% in large-caps)

Has this approach yielded positive results? Handsomely! (See chart below where mid caps have outperformed large-caps)

5 year performance comparison — Large Vs Mid Vs Small Cap Indices

How does this relate to and justify last one year under-performance of equity portfolios?

So, yes we did the right thing by tilting away from large-caps to attain this medium term out-performance depicted in the chart above, but there are bouts of short-term pain that our clients have digested for achieving such superior results.

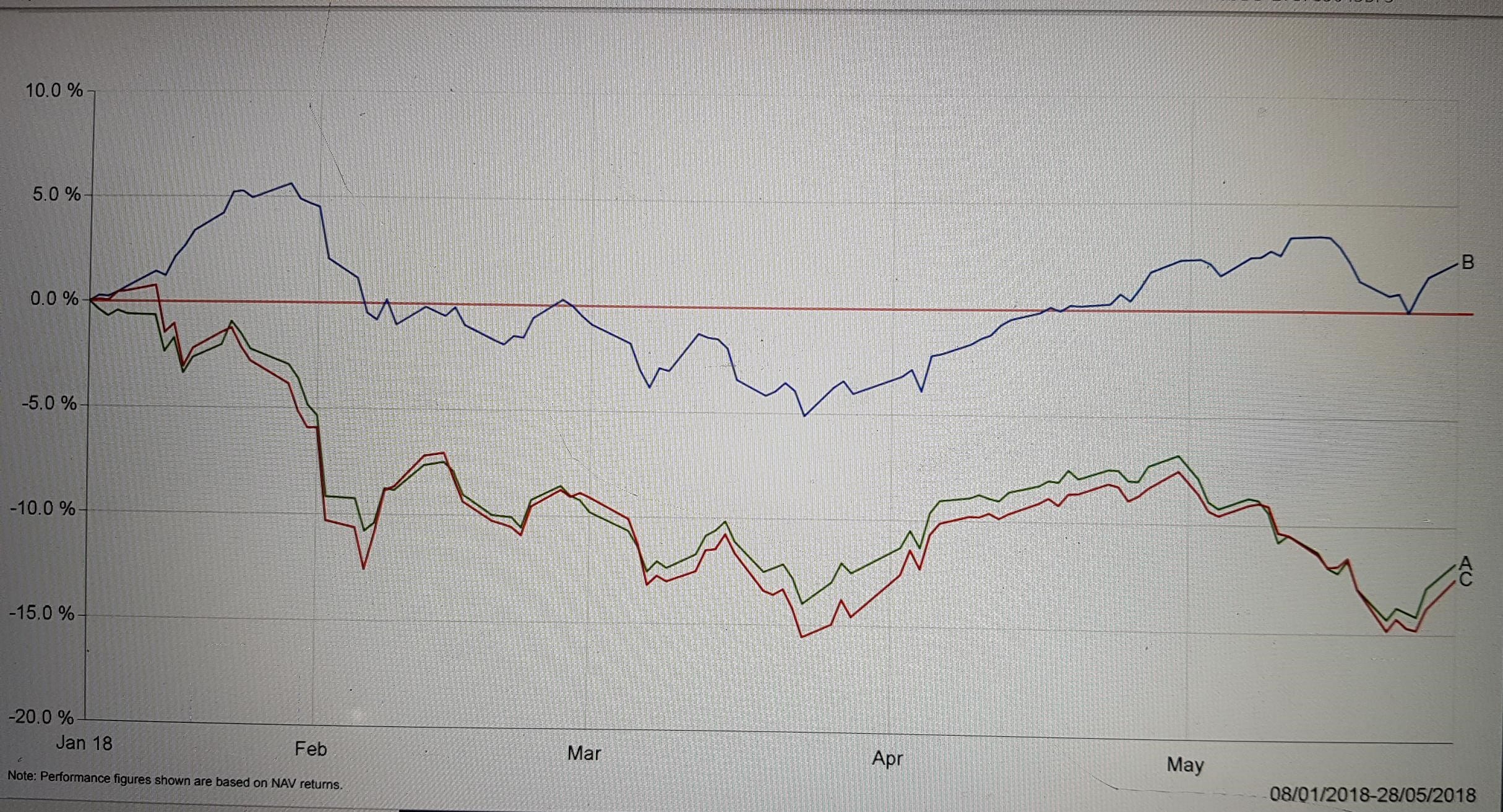

The current 4-month dip, which started in Jan ’18 end (and still continues), is one such period. Obviously the trigger for this particular dip was imposition of taxes by the government on long-term capital gains of equity oriented investments.

Taking cue from step-1, in a sliding equity market scenario, reverse holds true i.e. mid-caps should under-perform large-caps. Did it happen? Yes again (see below chart).

As we stand today (ending May ‘18) large-cap is almost at par compared to it’s high in Jan ’18 end, but mid/small cap are still about 12% absolute negative. This blow has actually caused large-caps to outperform over the entire last 1 year performance period. (and not only the last 4 month performance)

So portfolios like ours, which are by design cautiously over-weight on mid-caps, should under-perform by definition.

But to achieve a more robust out-performance over a 5 year period, such 4 (or even more) months of under-performance is the price we have to be willing to cough up. (See chart 1 and 2 together)

Think of it as a strategy to win a marathon. You don’t need to be the fastest runner in every lap to win a marathon.

To conclude, if any new equity portfolio is outperforming in the last one year it calls for investigation! Is it due to too much concentration risk? Is it constructed on the basis of a negative equity market outlook?